Unlock Bitcoin

yield for DeFi

Making hashrate work for you

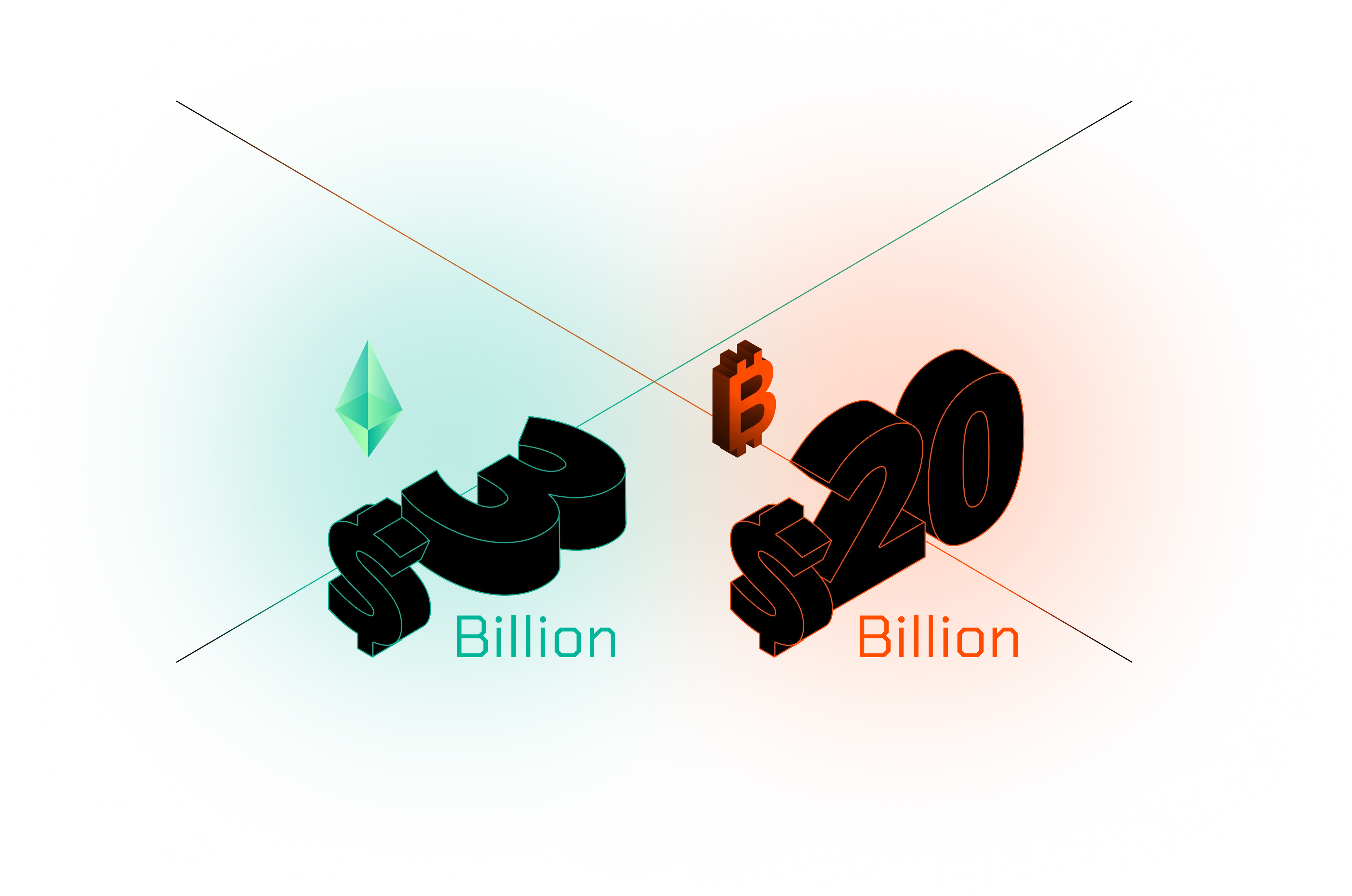

TeraHash reveals the potential of BTCfi with one of the highest on-chain yields

Hashrate = Yield

TeraHash is a hashrate staking protocol, that allows users to buy, stake and trade bitcoin hashrate

Operates on the hashrate basis, the most transparent sources of yield, gained by the Bitcoin network

Makes Bitcoin yield accessible and liquid through DeFi

Sets a new standard for composable and programmable yield on chain

TeraHash is powered by a dual-token model

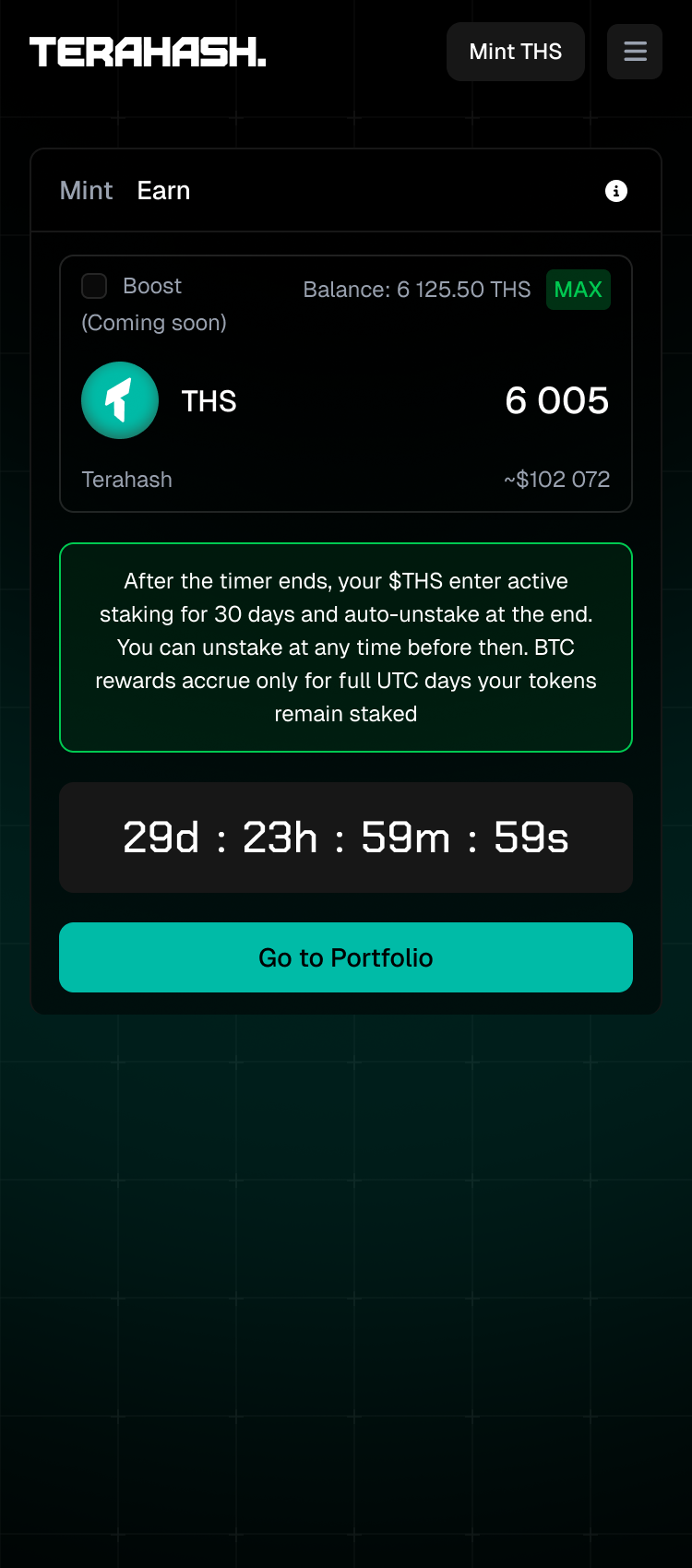

Easy Minting

Mint $THS using popular tokens like ETH, USDT, USDC, and others

Hashrate-Backed

Every $THS is fully backed by real, audited Bitcoin hashrate

Real BTC Yield

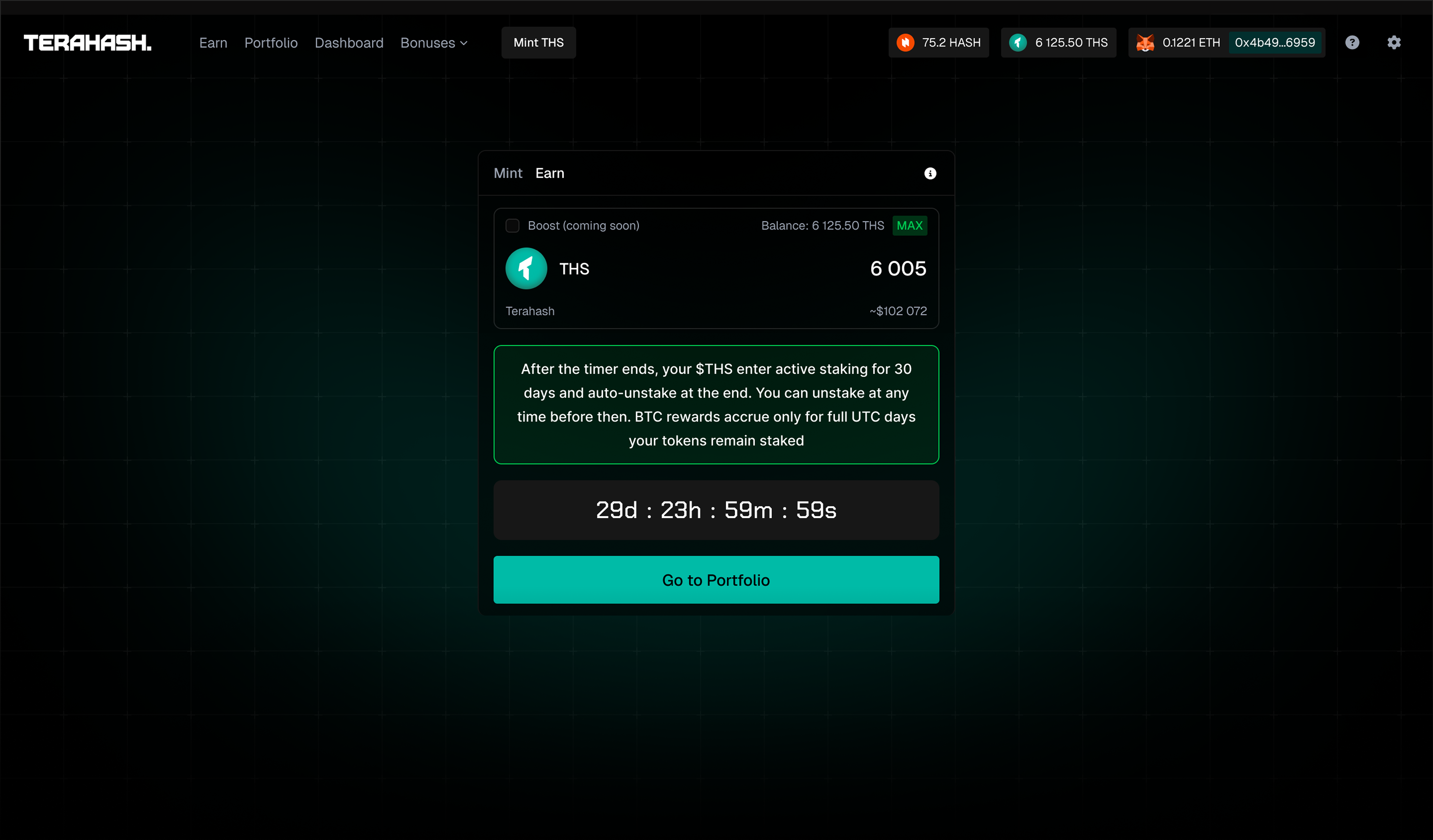

Earn native BTC yield by staking $THS

Daily Rewards

Receive wBTC rewards directly to your wallet, distributed daily

The global ecosystem over THS is the engine of composable Bitcoin yield

Lending & Collateralization

Use $THS as collateral to borrow stablecoins or other assets — or supply $THS liquidity to earn passive yields

Yield Tokenization

Unlock flexible DeFi strategies by tokenizing $THS yield streams into fixed or variable income assets.

Stablecoin Backing

Mint decentralized stablecoins backed by $THS — gaining utility and liquidity while maintaining mining exposure

Insured Mining

Protect mining hardware against market drawdowns or equipment failure with $THS-backed insurance — designed for retail miners, priced below typical yield levels

$THS Liquid Staking

Stake $THS to receive a liquid derivative token that preserves yield while unlocking full composability across the DeFi stack

BTC-Backed Credit

Borrow $THS against BTC collateral — stay long on Bitcoin while putting your assets to work

Market Liquidity Programs

Collaborate with market makers across spot and derivatives platforms to boost $THS liquidity and efficiency

Other products

Explore an ecosystem of modular products built on Liquid Bitcoin Mining — from UX enhancements and rapid deployment to security tooling and network hardening

Governed by the Community. Audited by Design

TeraHash is governed by its users. Built for decentralization, transparency, and alignment

Secure & Transparent

All votes are executed via smart contracts, ensuring fairness and immutability

Stake and Vote

Voting doesn't stop rewards. Tokens stay active and earning

Community-Led Decisions

From upgrades to stability reserves, the DAO shapes protocol evolution